Macro Update: The Lasting Impact of this Banking Crisis on Fintech

Given the recent turmoil in markets, the intersection of macro and fintech has come center stage.

Last week Silicon Valley Bank, Silvergate, and Signature Bank all failed. I won’t rehash all that happened as many other bright minds have, but in summary a combination of 1) poorly hedged interest rate risk, 2) declining liquidity ratios as deposit growth stalled and long-term investments underperformed, 3) lack of diversification in user bases, and 4) a run on the bank led by faster social media group-think all simultaneously led to these banks coming under receivership by the FDIC. Ultimately, a joint statement by the Fed, Treasury, and FDIC to backstop depositors became necessary. Yet, we are still waiting to see whether these were idiosyncratic events or canaries in the coal mine. With Credit Suisse tapping the Swiss National Bank in the midst of its own liquidity crisis, and ultimately selling to UBS at a steep discount over the weekend, and First Republic receiving investment from a consortium of big banks only to still trade down to all-time lows, it is unfortunately starting to look like this could be a broader macro crisis.

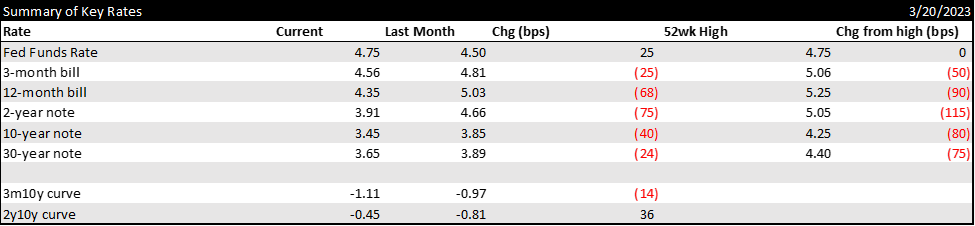

As a result, the front end of the bond markets has gone ballistic. On March 8th, the 1y bill hit 5.25%, indicating 50bps of more hikes over the next year as inflation remains a problem. Just a few days later, the 1y bill hit 4.30%, indicating nearly 50bps of rate cuts over the next year as a banking crisis takes its toll on the economy. That three-day swing is an 11x standard deviation move for 1y bills! Currently, it hovers around 4.35%, still indicating a drastic shift in fed policy over the next year. Looking at the broader curve, the 3m10y curve flattened to its lowest level since 1981, a huge recession indicator.

The reason the bond market is struggling to assess the current situation is that the Fed is in an increasingly impossible situation. The backstop of SVB and other regional banks is a form of quantitative easing that exacerbates inflation risk and makes treasury bonds extremely valuable (why sell bonds trading at a discount, when you can pledge them to the Fed at par?). That gives the Fed even more reason to hike, particularly with inflation still at 6%, well above its 2% target. However, continuing to hike rates when higher rates were a critical cause of the bank collapse in the first place could lead to an even more devastating crisis of confidence in our banking system. If we are done with hikes, it’s safe to say inflation is sticking around for longer.

What’s next? The lasting impact on fintech

Now a big question is how has this banking crisis affected fintech? We are still in the early days of figuring this out, but here’s where I see it:

Mass shift to safety will challenge consumer fintechs: Acquiring valuable customers will be more costly and retaining customers more challenging. Attractive LTV:CAC ratios will become difficult to maintain as customers opt for perceived safe alternatives. This shift will intensify the one reason consumer fintechs typically fail: inability to build trust. Incumbent banks have spent decades, sometimes centuries, focused on building trust. We saw in the matter of minutes how quickly that trust can dissipate for Silicon Valley’s most treasured bank. And fintechs can likely succumb to social media contagion far easier. How can disruptors retain trust in the face of this banking skepticism? Instead of growth at all costs, we must see fintechs focusing on building trust.

Debt facilities will become prohibitively expensive for balance sheet heavy fintechs: SVB was one of the friendliest lenders to startups and one of the only banks that truly understood how startups work. As banks become more risk averse, debt facilities will become costlier, include burdensome covenants, and may even require asset backing. For asset-heavy fintechs, including proptechs and non-bank lenders, the SVB news is devastating. Venture debt may also become more challenging to raise, which has become a popular way for startups to increase runway and decrease working capital constraints.

Larger banks will have more money to experiment: Despite what the broader fintech community may want you to believe, many larger banks have embraced digital innovation. With increasing consolidation of deposits at top banks, we will see these big banks continue to copy the digital features that consumer fintechs make popular, with little risk of not being the first mover. M&A will likely be a major theme over the next decade with consolidation at the top.

Crypto will win more users on the margin, but don’t expect a flight to “quality”: After FTX, crypto users were already moving towards non-custodial wallets. Could you draw up a better scenario for those wallets than a regulated bank failure and more government backstops? While we will see the anti-establishment user base grow, as we did after the financial crisis when bitcoin was first created, it will not be by as much as bitcoin-enthusiasts are prophesying. Trustworthy custodial solutions, including top five banks, still vastly outweigh the market size for non-custodial crypto solutions. Crypto companies must not rely on this macro tailwind and instead focus on enhancing the user experience to reach the mass market.

Regulatory changes are afoot: As usual when there’s a crisis due in part to under regulation (or at least supervisory failures), we will likely see regulation tilt too far the other way. Here are some key pieces of regulatory action that we may see:

More scrutiny on BCPs (Business Continuity Plans): SVB highlighted that financial institutions are not properly building in redundancy and do not have full clarity on their 3rd party reliances. Expect to have more requirements built into BCPs for a broader set of businesses beyond SIFIs (Systemically Important Financial Institutions) and for a broader set of outcomes. For instance, should regulated entities have a plan in the case they become an attacked party on social media? And what should be required of partner banks working with upstart fintechs?

Revamping deposit insurance: The $250k cap on deposit insurance is to stem moral hazard, making certain that depositors don’t park their money at risky banks with high APYs just because of an implicit guarantee on their deposits. Yet, there may be ways to increase the cap while still avoiding moral hazard.

Lowering the asset base that requires Dodd-Frank level scrutiny: Re-enacting what was rolled back in 2018 by the Trump administration seems like an easy target, but likely only happens if Democrats take back full control of Congress.

Uninsured deposits will be deemed riskier to banks: Regulators keep a close eye on bank liquidity ratios. Currently, uninsured deposits are treated 90% as secure as insured deposits when calculating these ratios. Now that faster payments, online banking, and open-banking enable the movement of deposits at a click of a button, this will rightly be revisited. One of the reasons SVB was at such risk was that only 4% of their accounts had less than $250k. Excess funds proved much less sticky than insured funds.

Real-time access to data via APIs: Unless requested otherwise, regulators still see reports on a quarterly basis. We’ll likely see a push towards faster and more open access to financial data for regulators. While banks have lobbied against this over time as it inhibits flexibility with quarterly reports, the reasons for real-time monitoring are becoming too compelling to overlook.

Circuit breakers on the removal of deposits: While deposits should always be available to customers, in the age of social media driven events we may see circuit breakers similar to that of the stock market when prices drop precipitously. Tricky to implement properly, but even a short delay could provide time to shore up a capital base.

So those all sounded bearish for fintech, are there any new opportunities for fintech that have arisen? Of course. When the traditional financial system struggles it is not just regulation that can help fix it. There is a clear opportunity for technology to strengthen the system we have today. In my mind, fintech has never been about replacing incumbents, but about creating a cheaper, faster, safer, and more accessible financial system. Here are some ideas of where innovation related to this crisis may come from:

Treasury management solutions with a focus on being more efficient with your money. Particularly, enhanced sweeps programs to diversify funds for large depositors and automated money movement into and out of Treasury bills.

On the banking side, we’ll likely see a next-gen version of Intrafi, an intra-bank cash sweep network to manage deposits for banks.

Analytics infrastructure to assess your counterparty risk across your financial supply chain.

More esoteric debt with tech enabling creative ways of valuing assets. SVB is leaving a gap that risk-averse larger banks likely won’t fill in the short term.

Payments companies that help build redundancy into your platform, simplifying the movement of money across multiple rails.

New-aged ratings agencies after yet another failure of our ratings agencies to warn customers in time.

New ways to proactively build trust. Regional Bank CEOs are giving out their cell phone numbers to anxious customers who need reassurance. Tech will work on more scalable solutions to create trust in the system.

Hopefully we aren’t in complete war mode just yet, but either way it’s worth taking Winston Churchill’s words of wisdom, “never let a good crisis go to waste.” We saw disruptors like Brex, Mercury, Synapse, and AngelList spin up new fintech products in a weekend to address contagion in the market. This speed of innovation will continue and despite a rocky week for tech companies, there’s ample opportunity ahead.

Thanks to the Core team, Arjan Schutte, Edwin Loredo, Susan Ehrlich, and Adam Shapiro for their thoughts. Always welcome comments and feedback, hit me up on twitter @roosontheloos.